The Reserve Bank of Australia (RBA) has ended the year with a steady hand, keeping the cash rate at 3.6% at its final meeting of 2025. The decision was widely expected, but the real story is in the statement by the monetary policy board and what it reveals about the RBA's thinking for next year. The RBA acknowledged inflation has become more complicated.

The RBA is stuck in a tug-of-war, as it holds rates steady

The Reserve Bank of Australia (RBA) has ended the year with a steady hand, keeping the cash rate at 3.6% at its final meeting of 2025. The decision was widely expected, but the real story is in the statement by the monetary policy board and what it reveals about the RBA's thinking for next year.

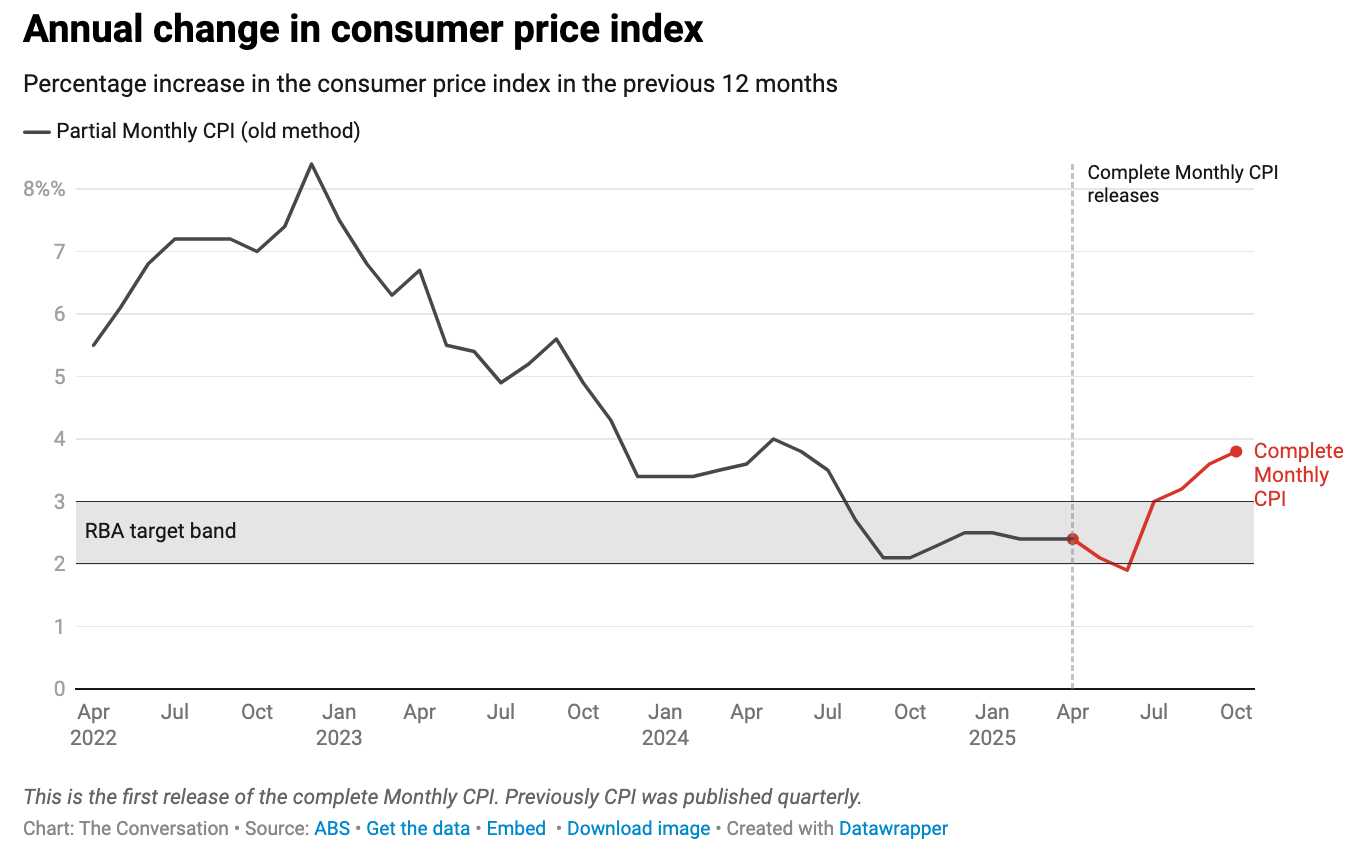

The RBA acknowledged inflation has become more complicated. While price pressures have eased significantly since the 2022 peak, the bank noted inflation "has picked up more recently". It said the latest data:

suggest some signs of a more broadly based pick-up in inflation, part of which may be persistent and will bear close monitoring.

In short, rate cuts are off the table for now.