One of Australia's largest licensed club operators is under legal scrutiny, accused of allowing nearly $140 million to be gambled by individuals considered at high risk of money laundering and terrorism financing. AUSTRAC has initiated civil proceedings in the Federal Court against Mounties Group.

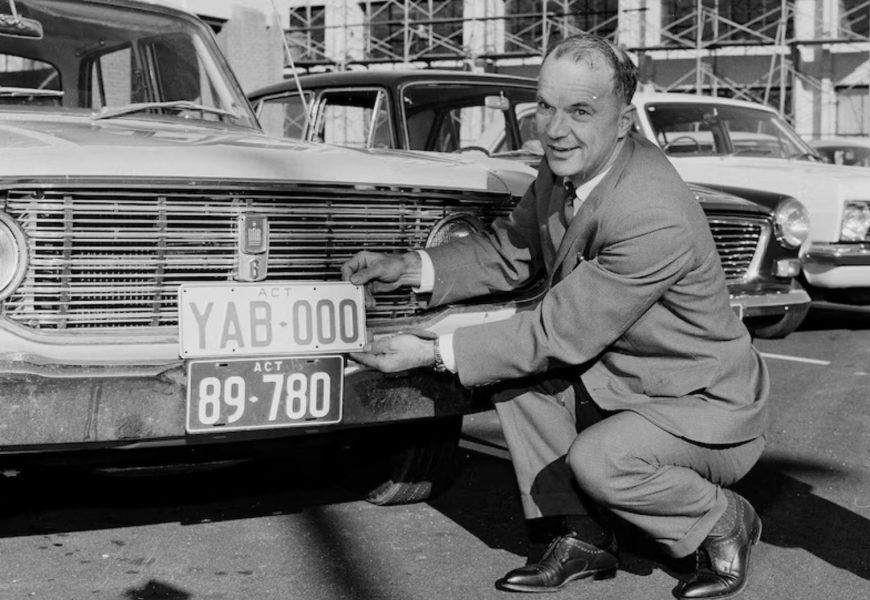

Mounties Club Group Accused of Failing to Prevent $140 Million in Suspected Illicit Gambling Transactions

One of Australia's largest licensed club operators is under legal scrutiny, accused of allowing nearly $140 million to be gambled by individuals considered at high risk of money laundering and terrorism financing.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) has initiated civil proceedings in the Federal Court against Mounties Group, which operates 10 venues across Sydney's south-west, the North Shore, and the Central Coast.

According to court documents filed by AUSTRAC, the group's network of approximately 1,400 poker machines processed $4.17 billion in turnover between 2019 and 2023. AUSTRAC claims that Mounties failed to implement proper anti-money laundering (AML) and counter-terrorism financing (CTF) measures during this period.

"Mounties served innumerable customers without adequate controls," the agency alleges. "The sample of high-risk customers alone turned over more than $139.85 million and received payouts exceeding $10.46 million."

AUSTRAC further claims these alleged breaches left the Australian financial system and broader community exposed to long-term, systemic risks associated with money laundering and terrorism financing.

Mounties, officially registered as Mount Pritchard and District Community Club, declined to comment on the legal proceedings, but issued a statement last week acknowledging the case.

"We are reviewing AUSTRAC's Originating Application and Concise Statement regarding alleged breaches of our AML/CTF obligations," the group stated. "Since AUSTRAC raised its concerns, we've been making significant investments to improve our compliance capabilities."

Among its venues, Mounties in Mount Pritchard regularly ranks as the most profitable poker machine venue in New South Wales.

Brendan Thomas, AUSTRAC's CEO, said the case marked a significant milestone as the first time the agency has brought legal action against a registered club.

"This sends a strong message to clubs and hotels across the country. They need to understand their operations, ensure they have adequate controls, and meet their legal responsibilities," he said.

New South Wales is home to more than half of Australia's poker machines. In the financial year ending 2024, around 88,000 machines in clubs and pubs generated $8.4 billion in profit and contributed $2.3 billion in tax revenue, according to the state's Auditor-General.

In its case, AUSTRAC detailed a sample of 10 customers it identified as high-risk for money laundering or terrorism financing. These individuals reportedly showed multiple red flags, such as:

- Gambling frequently-almost daily

- Betting large amounts inconsistent with known financial circumstances

- Receiving large or numerous cheque payouts

- Inserting substantial amounts of cash with little to no game play

- Exchanging money or gambling credits with other patrons

- Triggering investigations by Liquor and Gaming NSW

Mounties reportedly identified eight of the 10 individuals and reported seven to AUSTRAC. However, the agency alleges that the group's compliance system was not fit for purpose.

"The compliance program in place was not capable of identifying or managing the money laundering or terrorism financing risks," AUSTRAC claims.

Mounties' AML/CTF compliance is outsourced to Betsafe, a third-party provider also used by other licensed clubs. Betsafe has also declined to comment on the allegations.

AUSTRAC further alleges that Mounties failed to prevent suspicious activities such as "bill stuffing," a tactic where gamblers deposit large amounts of cash into machines and then withdraw it as a cheque with minimal or no gambling.

Other alleged practices include exchanging winning tickets or credits for cash with other gamblers, using multiple cash-out terminals to avoid scrutiny, and exploiting relationships with staff to bypass identification checks.

Legal proceedings remain ongoing.