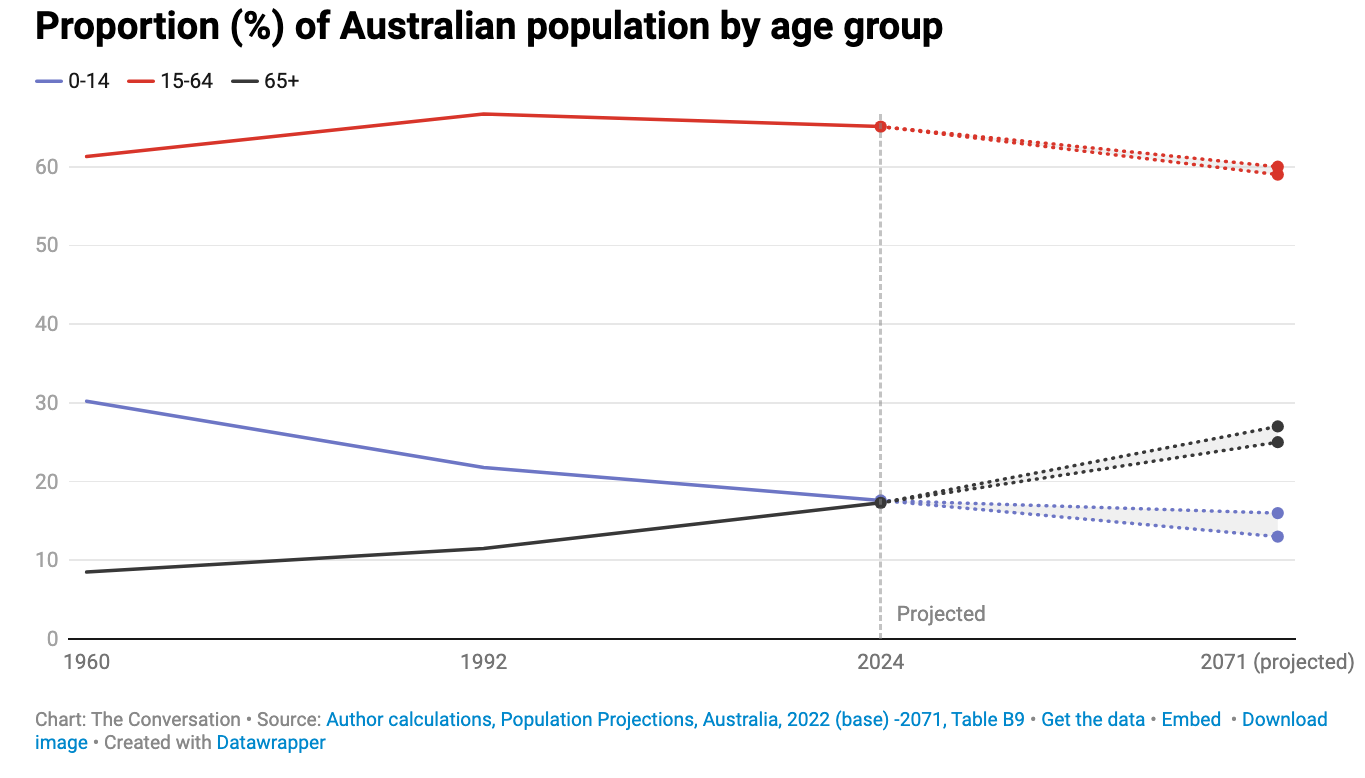

An extensive government review of the Reserve Bank of Australia (RBA) in 2023 made 51 specific recommendations to enable "an RBA fit for the future". But the narrow terms of reference confined the review to an economic lens. The failure to investigate the effectiveness of monetary policy setting through a demographic lens has resulted in an RBA which is no longer fit for purpose.

As the population ages, the RBA's interest rate policy is no longer fit for purpose

An extensive government review of the Reserve Bank of Australia (RBA) in 2023 made 51 specific recommendations to enable "an RBA fit for the future". But the narrow terms of reference confined the review to an economic lens.

The failure to investigate the effectiveness of monetary policy setting through a demographic lens has resulted in an RBA which is no longer fit for purpose.

The Reserve Bank has just one policy tool - the setting of official interest rates - to manage the economy and achieve its twin goals of:

- low and stable inflation

- full employment.

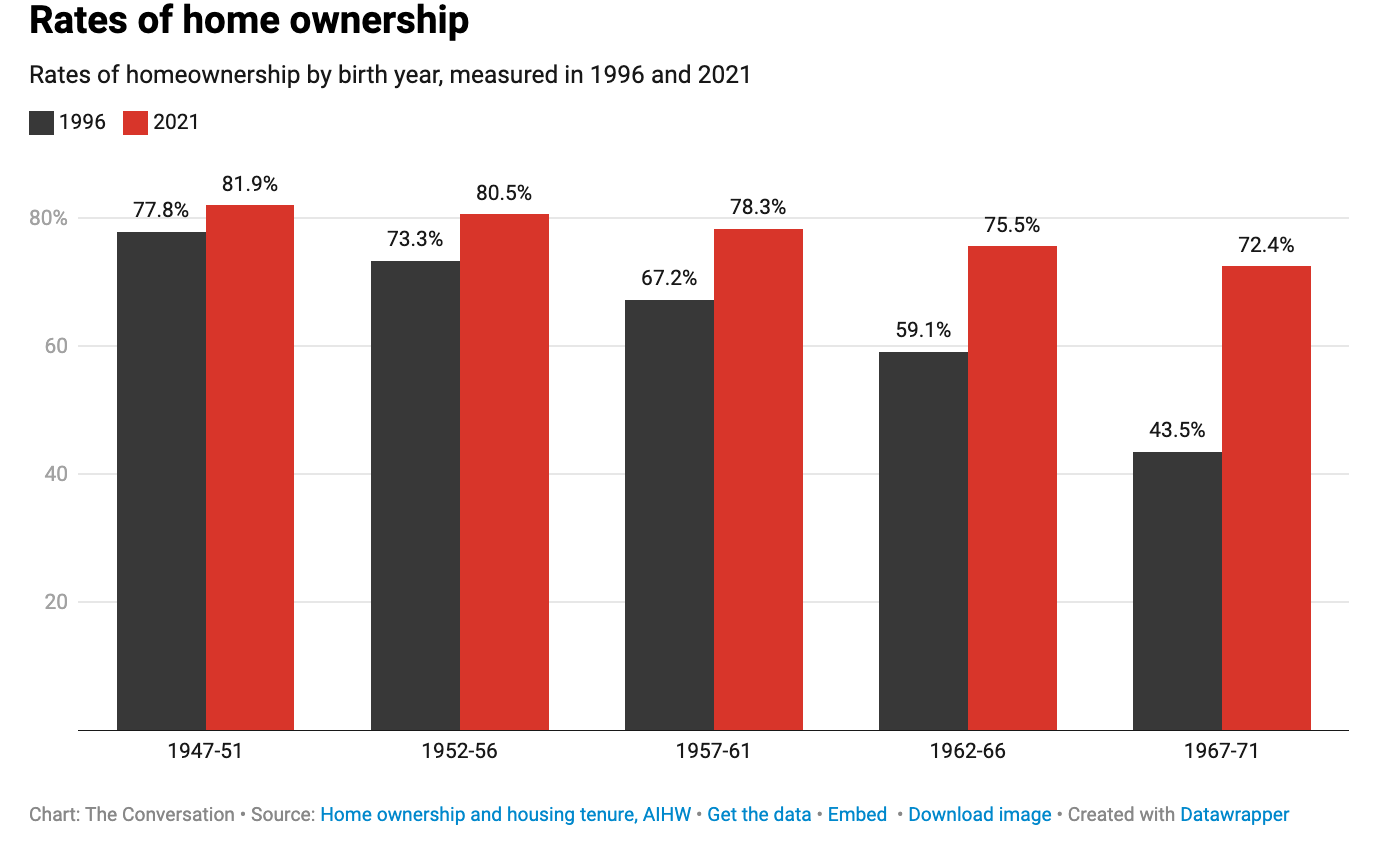

From a demographic perspective, the reality is that a large and growing proportion of the population is retired, with tax-free income thanks to superannuation and secure home ownership. They are immune to interest rate changes and may actually be fuelling inflation because their spending is not affected by interest rate rises.