NEW YORK (AP) - Stock markets worldwide are careening even lower Friday after China matched President Donald Trump's big raise in tariffs in an escalating trade war. Not even a better-than-expected report on the U.S. job market, which is usually the economic highlight of each month, was enough to stop the slide.

Sell-off worsens worldwide and Dow drops 2,200 after China retaliates against Trump tariffs

NEW YORK (AP) - NEW YORK (AP) - The worldwide sell-off for financial markets slammed into a higher, scarier gear. The S&P 500 plummeted 6% Friday, the Dow Jones Industrial Average plunged 5.5% and the Nasdaq composite dropped 5.8%.

Markets are facing their worst crisis since the COVID crash after China matched President Donald Trump's big raise in tariffs in an escalating trade war. Not even a better-than-expected report on the U.S. job market was enough to stop the slide. The price of oil slid to its lowest level since 2001.

So far there are few, if any, winners in financial markets from the trade war. European stocks saw some of the day's biggest losses, with indexes sinking more than 4%. The price of crude oil tumbled to its lowest level since 2021. Other basic building blocks for economic growth, such as copper, also saw prices slide on worries the trade war will weaken the global economy.

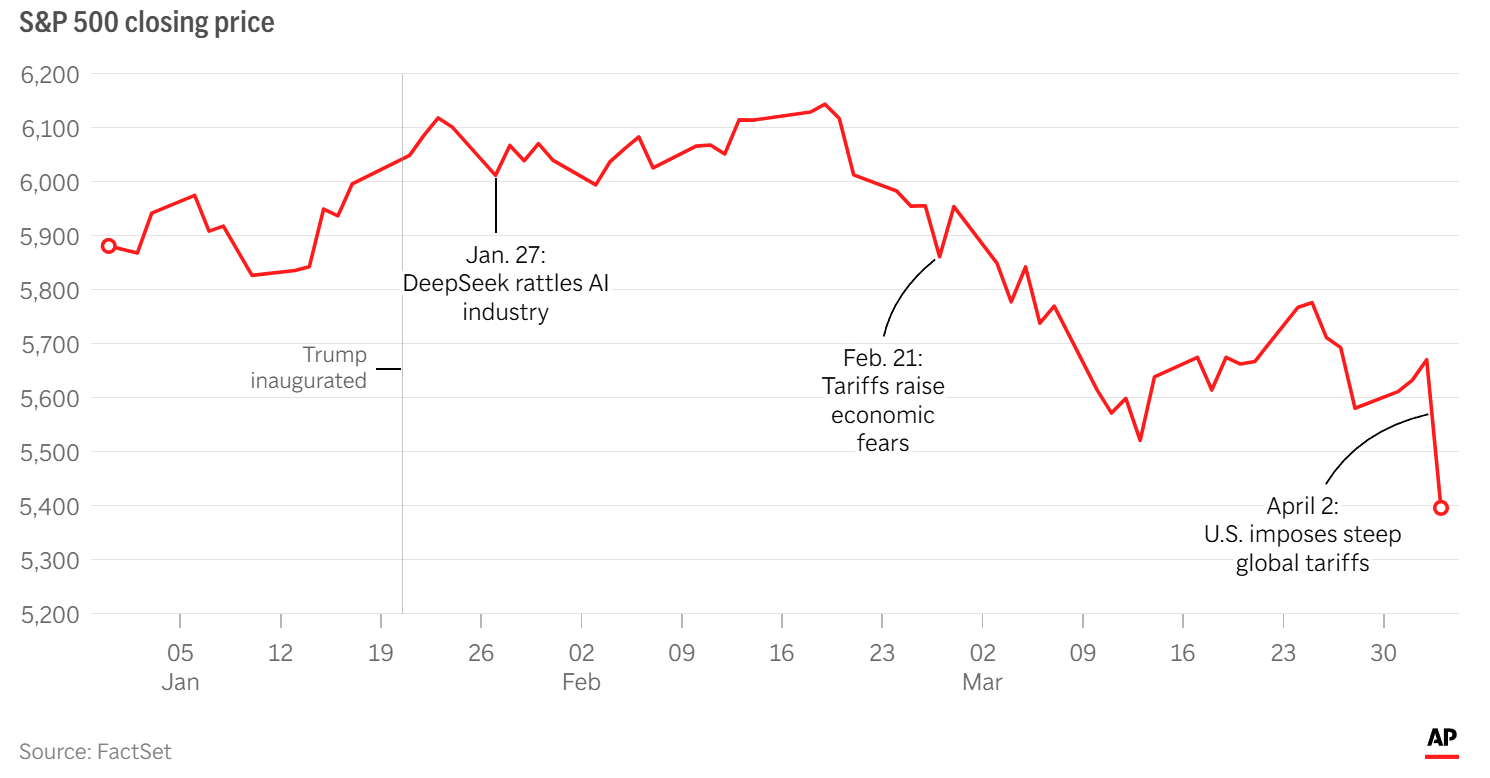

Stocks begin Q2 with skid

The S&P 500 followed its biggest quarterly loss in nearly three years with a drop in the first week of April. The index hit a record on Feb. 19 but has since tumbled on fears the Trump administration’s tariff-centered trade policies could spark inflation and slow the global economy.